What’s Juicy about Juicebox?

Insights from Juicebox on crypto fundraising and ownership management

TL;DR

The Juicebox protocol is one of a kind, offering several key insights for us to reflect and incorporate into our product design and roadmap:

- Juicebox has a significant branding in the crowdfunding space, making it the platform when it comes to crowdfunding, community-owned projects on Ethereum

- Tools like token settings allow projects to incentivize early investment and long-term commitment, taking full advantage of operating on-chain

- $JBX tokenomics powers a self-funded mechanism with an innovative pricing structure

The Platform for Crowdfunding on Ethereum

The Juicebox protocol, a leading Ethereum-based crowdfunding platform, is the birthplace of some of the most successful community-owned projects. Astonishing stories range from the ConstitutionDAO with $47 million worth of fundraising attempting to buy the first printing of the US Constitution, to MoonDAO purchasing Blue Origin tickets and sending a member of its own to space.

First launched in Summer 2021, Juicebox protocol has undergone three iterations. Started by founding engineers Jango.eth, Peri.eth and a few other core contributors, Juicebox has now powered over 1,000 projects on its platform and raised over $175 million worth of capital in total.

Juicebox protocol offers projects “a programmable treasury” and everyone can launch a crowdfunding project easily. It requires project owners to provide project details, token settings, and optional NFTs. All configurations are highly customizable for different types of DAOs or projects, including single-purpose DAOs, collective ownerships, or NFT-powered communities.

Fundraising on Juicebox is organized through different funding cycles, each of which clearly outline funding durations, target, and payout addresses. The excessive funds after the project reaches its target are considered overflow. Projects also need to set up an initial mint rate, indicating how many project tokens are minted for every ETH contribution.

FOMO, HODL, Algorithmically Designed

Among all configurations, two features of token settings are interesting, namely the discount rate and the redemption rate.

Discount rate means that tokens are cheaper in the current funding cycle and a contribution would get investors more tokens than a contribution of the same value made during the next funding cycle.

As rates are compounded across funding cycles, the cost of the token appreciates over time. Juicebox supports a 0%-20% discount rate.

For example, if a project has an initial exchange rate of 1:1,000,000 ETH/Token with a constant 10% discount rate.

- Funding Cycle #1: 1 ETH contribution worth 1,000,000 Token

- Funding Cycle #2: 1 ETH contribution worth 900,000 Token (10% deduction of previous cycle)

- Funding Cycle #3: 1 ETH contribution worth 810,000 Token (10% deduction of previous cycle)

As Jango first described, the discount rate is “mega powerful and has lasting effects.” Thus, this mechanism incentivizes investors to invest early, helping projects reach their fundraising goals faster.

Redemption rate determines what proportion of overflow can be reclaimed by a token holder when redeeming their tokens. For redemption rate less than 100%, a portion of assets will be left in the overflow to share between those who wait longer to redeem. Detailed calculation formulas can be here.

For example, if a project with 60% redemption rate has 100 ETH overflow, contributor A owns 10% of the project token, and contributor B also owns 10% of the project token.

- A can redeem and burn all the project token for 100 ETH * 10% * 60% = 6 ETH

- B’s allocation then bumps up from 1/10 to 1/9 after A redeemed. Thus, B can redeem and burn all the project token for 100 ETH * 1/9 * 60% = 6.67 ETH

With lower redemption rate, redeeming a token increases more value of each remaining token, creating an incentive for contributors to hold tokens longer than others.

Importantly, these tools can only be utilized on-chain, enforced by algorithms and smart contracts.

Self-sufficient Platform Powered by $JBX Tokenomics

To fully understand how token settings work, we can take the JuiceboxDAO and its $JBX token as an example.

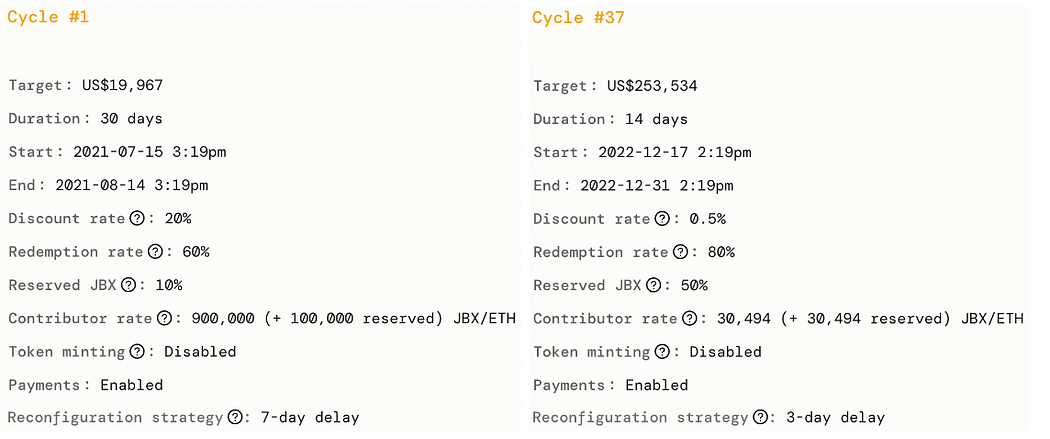

As shown on the first and latest funding cycle of JuiceboxDAO, we can clearly see some changes:

- Contributor rate changed from 1,000,000 JBX/ETH to 60,988 JBX/ETH, due to the compounding effect of discount rates over 37 funding cycles

- This leads to an appreciation of cost for minting $JBX

- Redemption rate increased to 80% due to a proposed change

- Together with circulating $JBX tokens on the secondary market, this leads to a ~687,537 JBX/ETH exchange rate on the secondary market.

This large price spread is how Juicebox is able to operate completely through self-funding.

For projects listed on Juicebox, the platform did not impose a traditional fee structure like Kickstarter or Republic. Instead, when projects withdraw funds from the Juicebox platform, they will pay a 2.5% membership fee and receive $JBX at the current issuance rate. This mechanism not only gains revenue for Juicebox, but also allows projects to get $JBX tokens and participate in the ecosystem.

Closing Thoughts

Overall, Juicebox protocol inspires us to think how on-chain fundraising and operations can be empowered through tokenomics and algorithmic mechanisms such as redemption and discount rates. As we move towards a more token-based capital market, which encompasses the entire crypto primary market and a tokenized secondary market, we are poised to leverage these powerful on-chain tools to design and deliver our product for the greater good.