NeuFi: How AI + crypto will converge to disrupt finance

Generative AI will converge with genetic tokens to catalyze the third wave of financial digitization, Neural Finance

What does the future of finance look like?

After crypto crashed in 2022, regulators like the SEC proceeded to stomp on it in early 2023. In the US, they let three banks closely related to crypto fail — SVB, Silvergate and Signature.

Investors — enamored by ChatGPT — have fled from crypto to generative AI, taking whatever funds that could be redirected with them.

So is it game over? Are all hopes dashed to disintermediate traditional finance — TradFi — with crypto and DeFi?

The signals are mixed.

Europe passed the Markets in Crypto Act, or MiCA, in April 2023.

Governments still murmur quietly about CBDCs, but none have crossed the chasm to anything beyond POCs — proofs of concepts.

Executives we interviewed in TradFi are still fascinated by crypto but remain in the learning phase. Many have refrained from pursuing additional POCs due to the poor optics of an uncertain future.

Questions linger: Are there gaps in the financial infrastructure that existing systems cannot address? If so, what technologies will bridge this gap?

Amidst these deliberations, one thing becomes clear: TradFi has reached a point of stagnation in their ability to innovate. Despite retrofitting their legacy systems for the Internet era, their underlying systems and processes remain largely unchanged. It’s akin to installing a dashcam and GPS in a conventional car while the world is swiftly advancing toward self-driving shared electric vehicles.

A new vision of finance for the 21st century is warranted.

In the next decade, AI and crypto will converge, and neural financial services — NeuFi — will emerge.

The 3 Waves of Financial Digitization

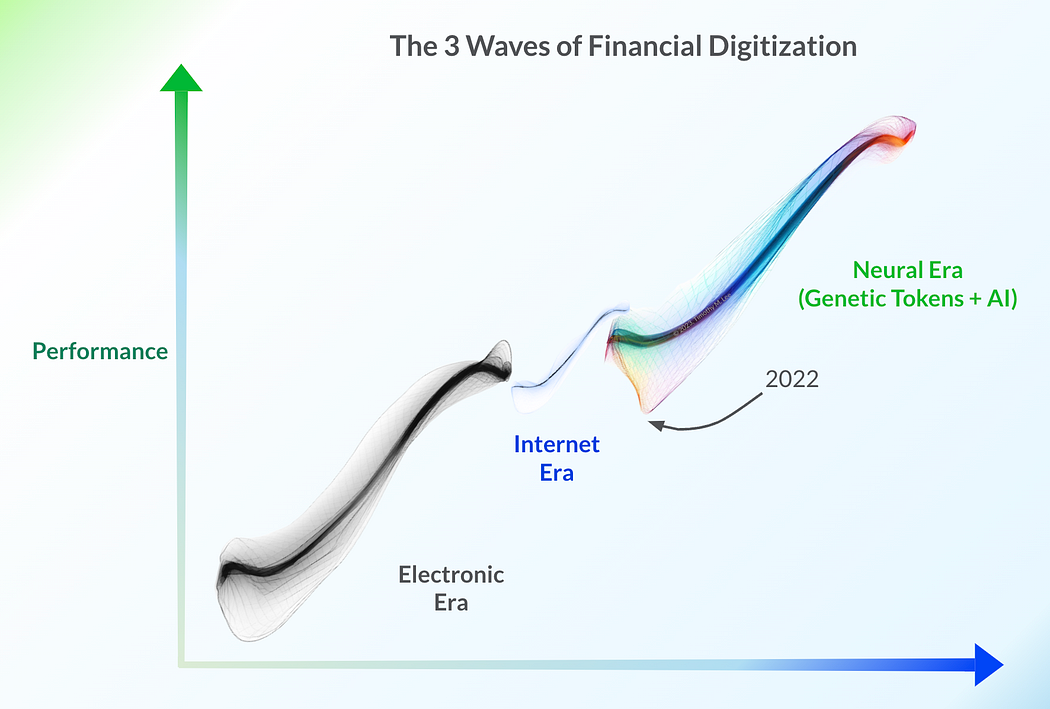

Let’s put this in perspective. Using the framework espoused by Clayton Christensen’s theory of disruptive innovation, financial services has passed through two macro innovation epochs, and is now entering the third wave — the neural era of digitization.

The Electronic Era

During the electronic era, fungible assets like money and securities were digitized, but only between trusted parties. This era brought forth algorithms, machine learning, and cryptography. Its legacy footprint remains today: ATMs, securitization, and the dawn of the gradual replacement of white-collar jobs.

The Internet Era

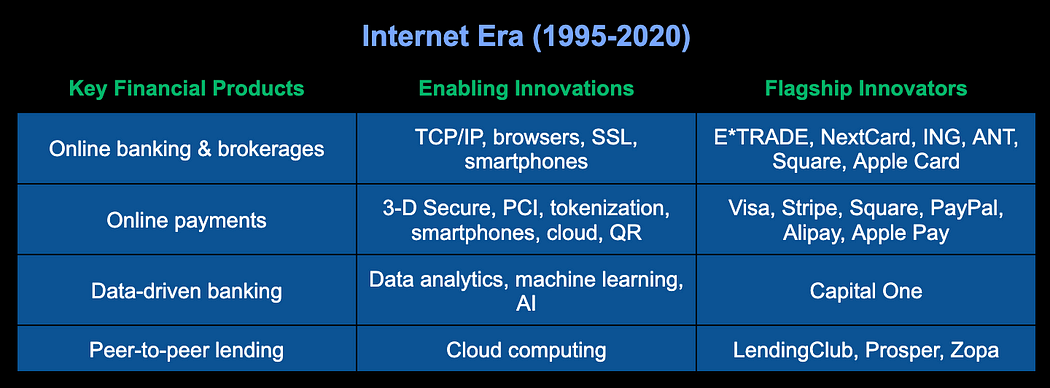

The Internet era connected these systems to each other and to consumer devices. It was built upon browsers, broadband, and BYOD. Its output was a critical step to the next era: user-friendly interfaces, big data predictive modeling, and machine learning.

The Neural Era

We are now at the dawn of the final era of digitization, the neural era.

The term “neural” derives its meaning from two fundamental concepts.

First, it encompasses genetic asset tokens — tokens issued by the sole originator of the asset (as further defined here).

Second, it incorporates generative AI that operates in a manner akin to the interconnected neurons found in the human brain, fostering intelligent thought processes. It utilizes techniques like deep learning, neural networks, and probabilistic modeling to compose and generate new financial instruments optimized for each entity. It thinks.

Neural finance will manage all dimensions of finance — from payments and loans to investments and accounting.

With the power to aggregate vast amounts of data, AI algorithms will generate predictive models that adapt instantly to real-world inputs, surpassing human capabilities in performance and risk assessment.

This will not be one size fits all. Neural finance will use preferences, patterns, and protections to personalize recommendations.

The key difference will be that neural finance will not only make recommendations and auto-execute them, but proceed to auto-create new financial instruments — generative tokens.

When creating generative tokens, genetic assets will be prioritized over collateralized assets. This prioritization will trigger a wave of tokenization across industries, leading to the migration of real-world inputs onto the blockchain. As a result, AI will gain the ability to instantly recalibrate its algorithms based on these real-world inputs, unlocking new levels of adaptability and accuracy.

2022 was the trough of disillusionment of the neural era. But the stalwarts holding a proper roadmap are persisting and will be rewarded disporportionately. Crypto projects defining this third era and constructing the building blocks include the Ethereum Attestation Service attestation service and EthSign’s TokenTable token distribution and management platform.

How big is the Opportunity Space?

The crypto projects that figure out how to add generative AI to the equation and apply it to asset tokenization will be the true winners in the future of finance.

Adding up the market caps of the top 25 flagships in the Internet era remains a small fraction of the market caps of the top 25 financial institutions that preceded them. The Internet didn’t disintermediate the traditional banking system. It empowered them. They copied the strategies of the Internet unicorns just sufficiently to maintain relevance.

Unlike the Internet era, the neural era will replace the core systems of the electronic era. This will threaten the financial titans, at least in their present form. The opportunity space is the entire financial services stack, not just a connecting and UX layer on top.

TradFi who adapt aggressively may still survive. Those that break free from legacy systems will thrive. But more likely it will be new players who define the new space.

This is another preview of the upcoming book QUADRILLION.

Follow me or DM to help with a peer review of the book.