Navigating the Dual Equity Paradigm: Stocks vs. Tokens

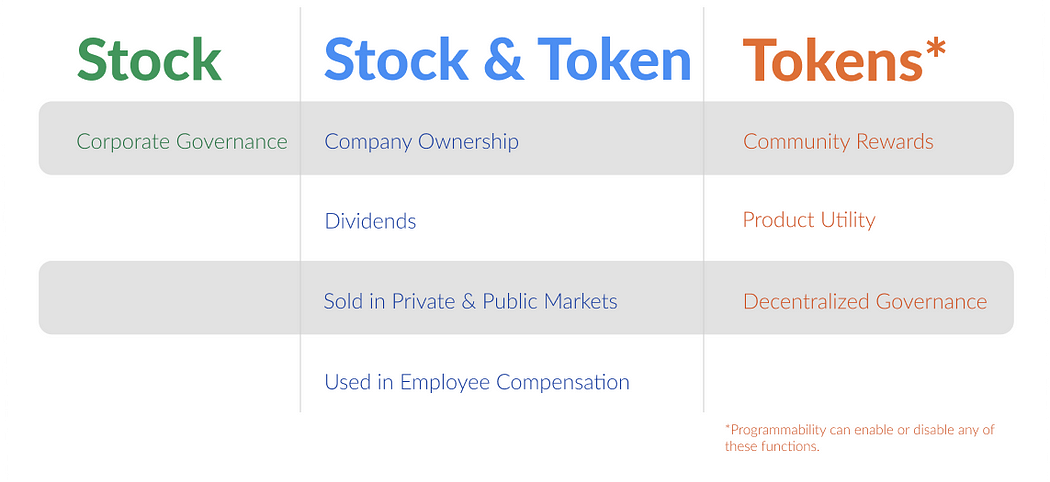

Tokens — digital, programmable units of value on blockchains — have emerged as a new form of equity that is redefining company ownership and stakeholder incentives.

Similar to stock, they can align the financial incentives of stakeholders, but with the added benefits of permissionless, traceable value transfer and unique programmability.

We’re now seeing a blend of these two forms of equity, with startups leveraging both stock and tokens. This “dual equity stack” represents an exciting, but complex new frontier for startup structuring.

As we explore this new dual equity paradigm, transparency and alignment of all stakeholders’ interests are key. The challenge and opportunity lie in designing and enforcing effective token allocation plans that account for the unique dynamics of each startup.

The Emergence of Token Based Equity

In traditional business, a company’s stock, or equity, signifies fractional ownership of the issuing corporation. A portion of the value a company creates by offering goods and services to the market accrues in its stock so shareholders have a common financial incentive to work towards growing the value of the company’s shares.

In the context of Web3, tokens are digital, programmable units of value that live on blockchains. Tokens enable permissionless and traceable value transfer due to blockchain’s decentralized nature. Since Ethereum popularized token sales in 2017, blockchain startups have used token-based equity for ownership representation and value accrual, sometimes replacing stock-based equity.

Financially, similar to stock, tokens align the incentives of token-holders, like the team and investors, towards the growth of the startup and the appreciation of its token. Thus, tokens can be sold for upfront cash in private fundraising, used in employee compensation, and traded on crypto exchanges.

The unique value proposition of token equity is that tokens empower the users within a product’s network to become shareholders who can take home some of the value that they help to create for the product. The programmability of tokens gives builders the flexibility to create incentive mechanisms that are uniquely customized to their product and business. Tokens can be used to: Reward specific behaviors eg. Ethereum rewards validators for staking their $ETH. Unlock product-related utility eg. on DAOMaker, a Web3 startup fundraising platform, users who stake more $DAO have higher allocations in curated crowdfunding rounds. Facilitate the participation in decentralized governance eg. on Uniswap, $UNI holders can vote in the governance of the Uniswap protocol.

Token equity can be generally categorized into security tokens, governance tokens, and utility tokens — or a mix of these properties. Token-economic mechanisms, such as programmatic token burning, minting, and buybacks, can be implemented to control how value accrues across the token supply. Furthermore, token transactions are transparently stored on-chain enabling the community to audit the token, which strengthens incentives by removing trust.

Today’s Web3 landscape is filled with companies that use both stock and token equity. Stock is more suitable for incentivizing the stakeholders of fast moving, early-stage startups, and natively digital tokens are more suitable for creating a network owned and operated by a large, global community. The popularization of this “dual equity stack” creates complexity for industry; as players figure out the different ways to structure and enforce mixed equity companies, industry best practices will emerge.

Lifecycle of Token-Issuing Startups

The three sequential objectives for crypto startup are:

- Build a product people want.

- Build a community and drive network effects around that product.

- Give ownership to that community.

Let’s look at the role of token-based equity in the lifecycle of Web3 startups:

- Planning: Before a startup mints their token, the team must plan how they will allocate their token to their various stakeholder groups.

- Fundraising and Hiring: Startup teams can raise funds from private-market investors by selling their stock or the rights to own/purchase tokens (that are typically generated in the future) in exchange for cash up front. Similarly, early employees can be compensated in stock or token grants/options to align their incentives with the startup’s success.

- Token Generation Event (TGE): TGE is the date that a startup’s tokens are generated on a blockchain for distribution. A startup may choose to generate a token to invite its user base to participate in ownership and operation of the product once the founding team has found product-market fit and established a viable. This aligns incentives among the network, its users, the core team, and venture investors. Akin to an initial public stock offering, TGE marks the point early stakeholders can begin to liquidate their token equity in public markets.

- Token Distribution: For team members and private investors who were allocated tokens before TGE, token distribution is done in accordance with the vesting and unlocking terms outlined in investment/employee compensation contracts. For community members and other stakeholders, public sales, airdrops, and rewards are popular means of distribution.

Choosing Stock or Token Equity: Considerations

Should stock or tokens be used to represent startup ownership?Early-stage startups are still in the process of discovering and refining their value creation and value capture mechanisms. They are not always well positioned to decide whether their startup’s value should accrue in their stock or token. Most founders and investors agree that stock is the best instrument for early-operations and fundraising because it simply facilitates long term incentive alignment between founders, their team, and investors. This allows founders to focus on finding product market fit without being obligated to think about producing a successful token.

Projects that commit to/have launched a token, usually, have an equity structure containing both stock and tokens. For example, the company Uniswap Labs builds the decentralized Uniswap protocol, which is governed by $UNI holders. This mixed structure allows the startup’s corporate entity to retain proprietary technology and talent, as well as to keep a private cap table and financials. The startup can then decide if, how, and when they plan to launch their token. Under this structure stock and/or tokens can be used to fundraise and compensate employees. And Warrants and/or pro rata agreements that dictate how stock converts into equity, or vice versa, so stakeholders hold the form of equity that aligns with their incentives. A mixed equity structure manifests as startups having two separate yet interconnected cap tables representing the distinct interests of equity stakeholders and token-holders.

How does stock equity convert to token equity?If the startup builds a product or network that produces a token, then agreements are used to facilitate how the investors and team members will receive tokens in proportion to their stock ownership in the company.

What is dilution? How does it affect the value of stock and token equity?Dilution is a common scenario in the startup funding ecosystem, where the proportional ownership of early stakeholders in a company is reduced as the company issues more shares to new investors during subsequent rounds of financing. Dilution is a common and accepted by stakeholders as it allows for an infusion of capital into the startup that fuels growth, and incentivizes participation in and growth of a product’s network. So, post-dilution a stakeholders ownership percentage maybe lower, but the value of their ownership ideally appreciates.

In Web3 startups community members contribute to the operation and success of a product’s network, so founders, investors, and team members agree to take on dilution from the community to fuel ecosystem growth, which leads to a larger pie overall for token holders to share.

How does crypto regulation affect the creation of token equity?Crypto and blockchain regulation is a gray area; founders are faced with the challenge of considering current and future evolutions in regulatory landscapes. The jurisdictions a startup chooses to incorporate in, where it builds products, and operates, should be considered carefully. To avoid infringing upon the U.S.’s Securities Act of 1933, most cryptocurrency exchanges require a token to be certified as a utility token before listing. But, given the recent rulings on Ripple’s $XPR case, and the ongoing Coinbase and Binance lawsuits, token regulations are likely subject to change.

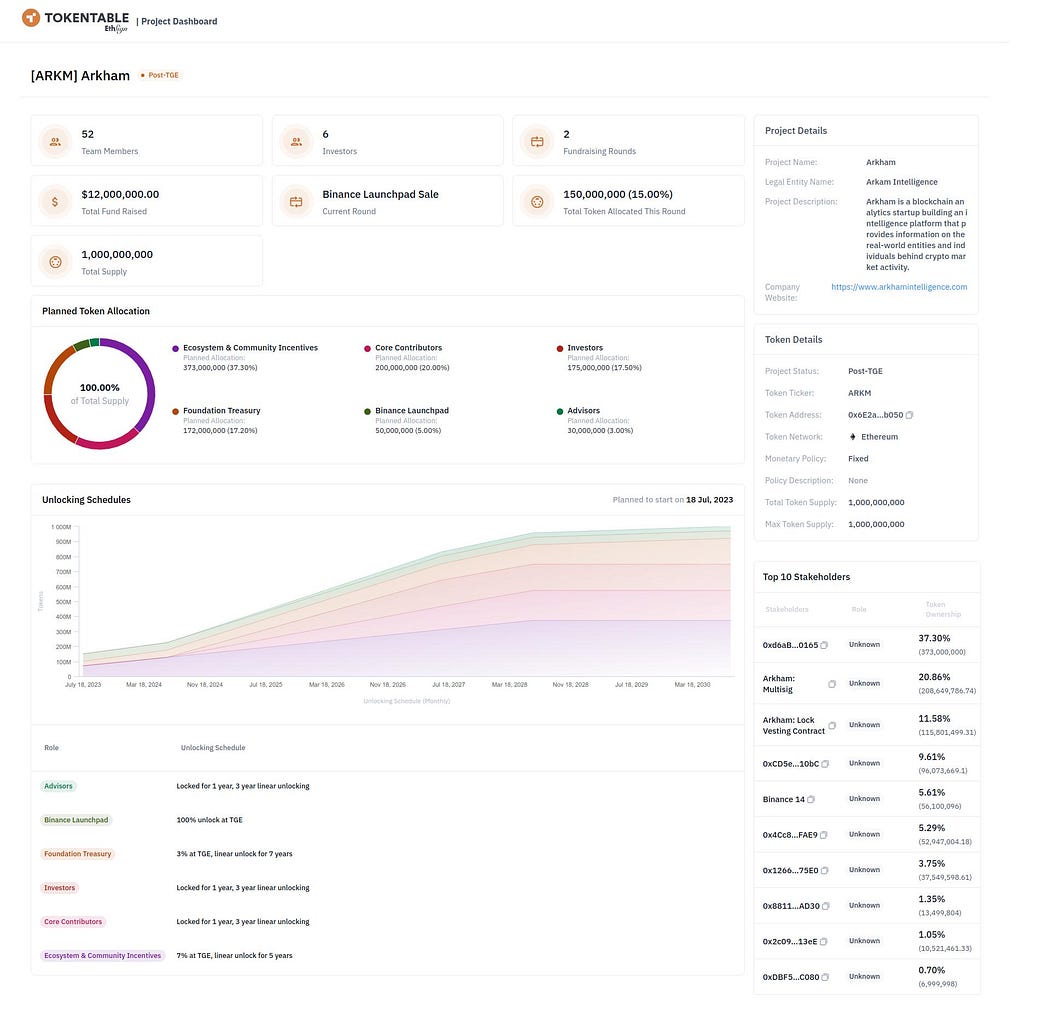

What makes a good token allocation plan?What is “good” is highly dependent on the startup and the nature of it’s product’s network. An effective allocation plan transparently ensures that the interests of all token-holders are aligned by making sure the right parties receive the right number of tokens based on the value they create for the product/network. An inadequate design can limit progress by creating conflicting incentives, negatively affecting the token’s price, and also create mistrust within the community.

Typically, aligning token-holder incentives involves maximizing community ownership and decentralization, creating sufficient incentives for core contributors and investors, and reserving enough for the startup’s treasury. A degree of community dilution of investors and team is common in order to drive network effects in a startup’s product ecosystem.

What does a typical token distribution plan look like?For context, here are the industry average percentages of total token supply allocation to common token-holder categories.

Hopefully this article gave you insight into how Web3 startups can use stock and token-based equity. If you’re interested in using TokenTable to manage your token equity or have any feedback or questions please reach out to ethanl@ethsign.xyz or @lippmanethan.

Disclaimer: The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only.